Waiting until spring to list your house no longer makes sense. Most listings come to market between April and June, so waiting to list means you’ll be met with a ton of competition. Let’s get together today to discuss why it makes more sense to list your house now!

Monthly Archives: December 2018

No Bubble Here! How New Mortgage Standards Are Helping

Real estate is shifting to a more normal market; the days of national home appreciation topping 6% annually are over and inventories are increasing which is causing bidding wars to almost disappear. Some see these as signs that the market will soon come tumbling down as it did in 2008.

As it becomes easier for buyers to obtain mortgages, many are suggesting that this is definite proof that banks are repeating the same mistakes they made a decade ago. Today, we want to assure everyone that we are not heading to another housing “bubble & bust.”

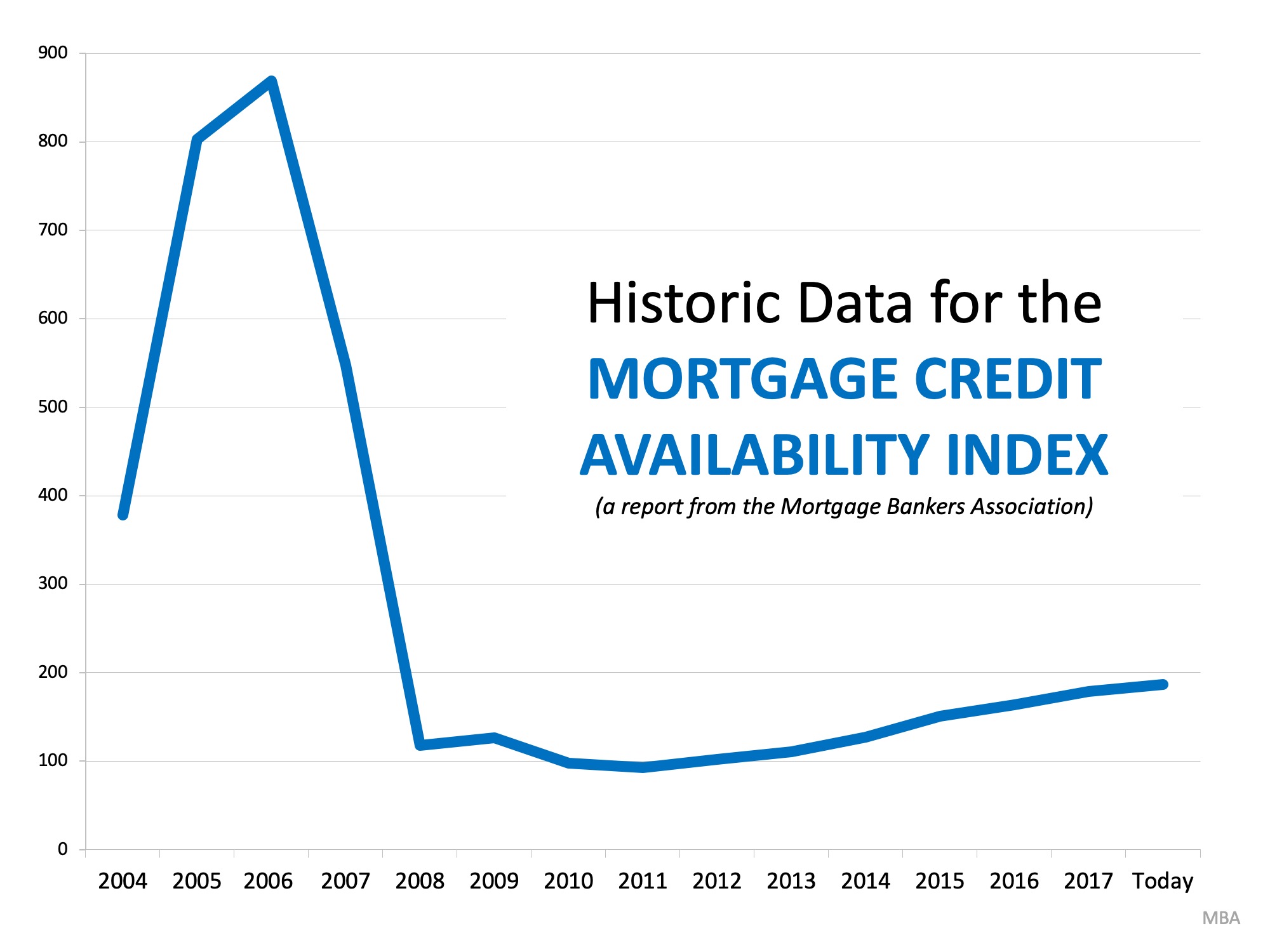

Each month, the Mortgage Bankers’ Association (MBA) releases a measurement which indicates the availability of mortgage credit known as the Mortgage Credit Availability Index (MCAI). According to the MBA:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.).” *

The higher the measurement, the easier it is to get a mortgage. During the buildup to the last housing bubble, the measurement sat at around 400. In 2005 and 2006, the measurement more than doubled to over 800 and was still at almost 600 in 2007. When the market crashed in 2008, the index fell to just over 100.

Over the last decade, as credit began to ease, the index increased to where it is today at 186.7 – still less than half of what it was prior to the buildup of last decade and less than one-quarter of where it was during the bubble.

Here is a graph depicting this information (remember, the higher the index, the easier it was to get a mortgage):

Bottom Line

Though mortgage standards have loosened somewhat during the last few years, we are nowhere near the standards that helped create the housing crisis ten years ago.

How to Simply Increase Your Family Wealth by Paying for Housing

Everyone should realize that unless you are living somewhere rent-free, you are paying a mortgage – either yours or your landlord’s. Buying your own home provides you with a form of ‘forced savings’ that allows you to use your monthly housing costs to increase your family’s wealth.

Every month that you pay your mortgage, you are paying off a portion of the debt that you took on to purchase your home. Therefore, you own a little bit more of your home every month in the form of home equity. As your home’s value increases you also gain home equity.

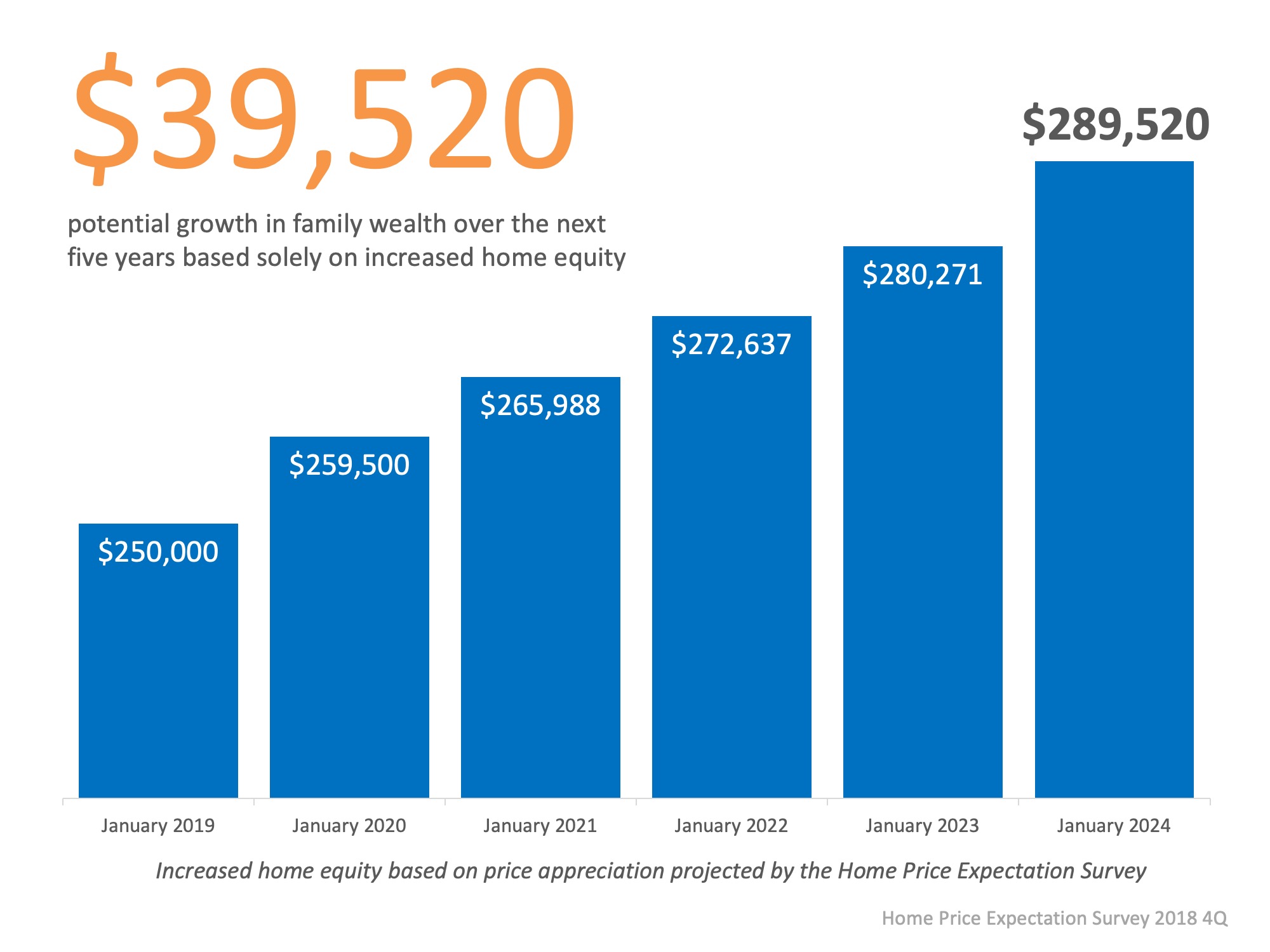

Every quarter, Pulsenomics surveys a nationwide panel of over 100 economists, real estate experts, and investment and market strategists and asks them to project how residential home prices will appreciate over the next five years for their Home Price Expectation Survey (HPES).

The latest data from their Q4 2018 Survey revealed that home prices are expected to round out the year 5.8% higher than they were in January. For the next 5 years, home values will appreciate by an average of nearly 3% a year.

This is still great news for homeowners!

For example, let’s assume a young couple purchases and closes on a $250,000 home in January. Simply through their home appreciating in value, those homeowners can build their home equity by nearly $40,000 over the next five years.

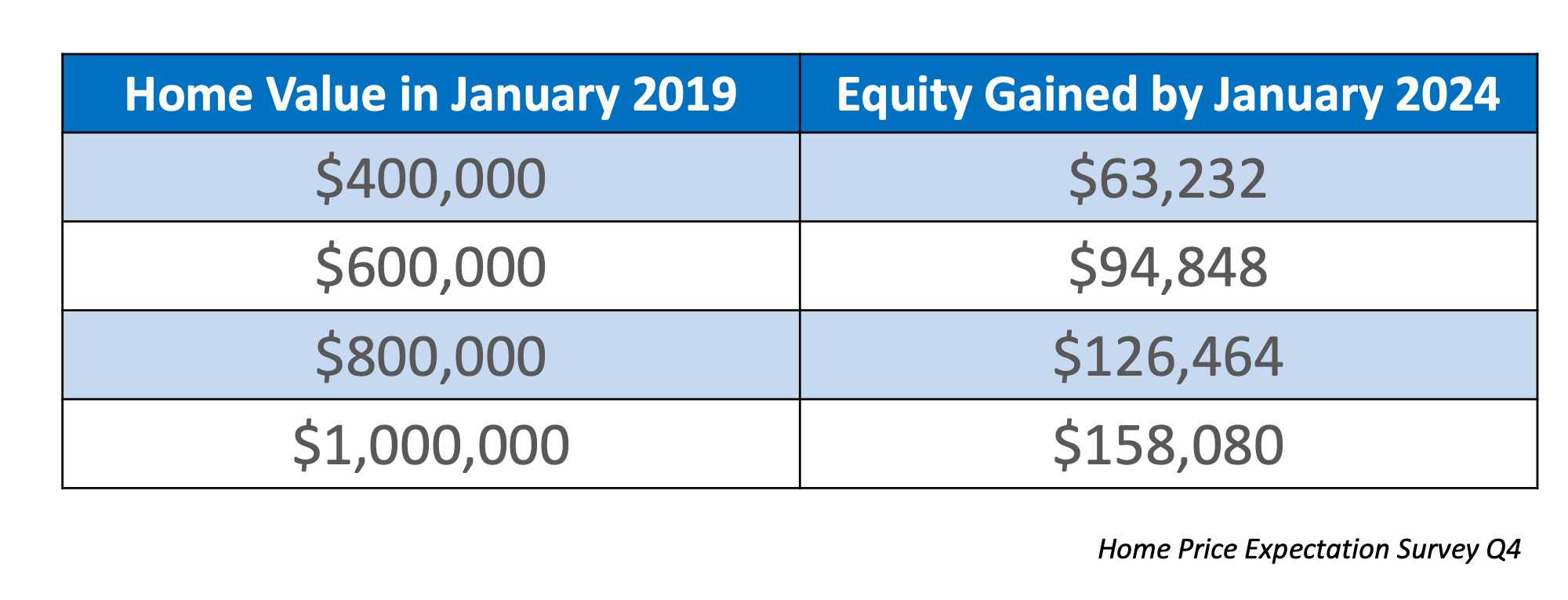

Let’s look at the potential equity gained over the same period of time at some higher price points:

In many cases, home equity is a large portion of a family’s overall net worth.

Bottom Line

If your plan for 2019 includes entering the housing market to purchase a home, whether it’s your first or your fifth, let’s get together to make your plan a reality!

What If I Wait A Year to Buy a Home?

National home prices have increased by 5.4% since this time last year. Over that same time period, interest rates have remained near historic lows which has allowed many buyers to enter the market and lock in low rates.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price but instead about the ‘long-term cost’ of the home.

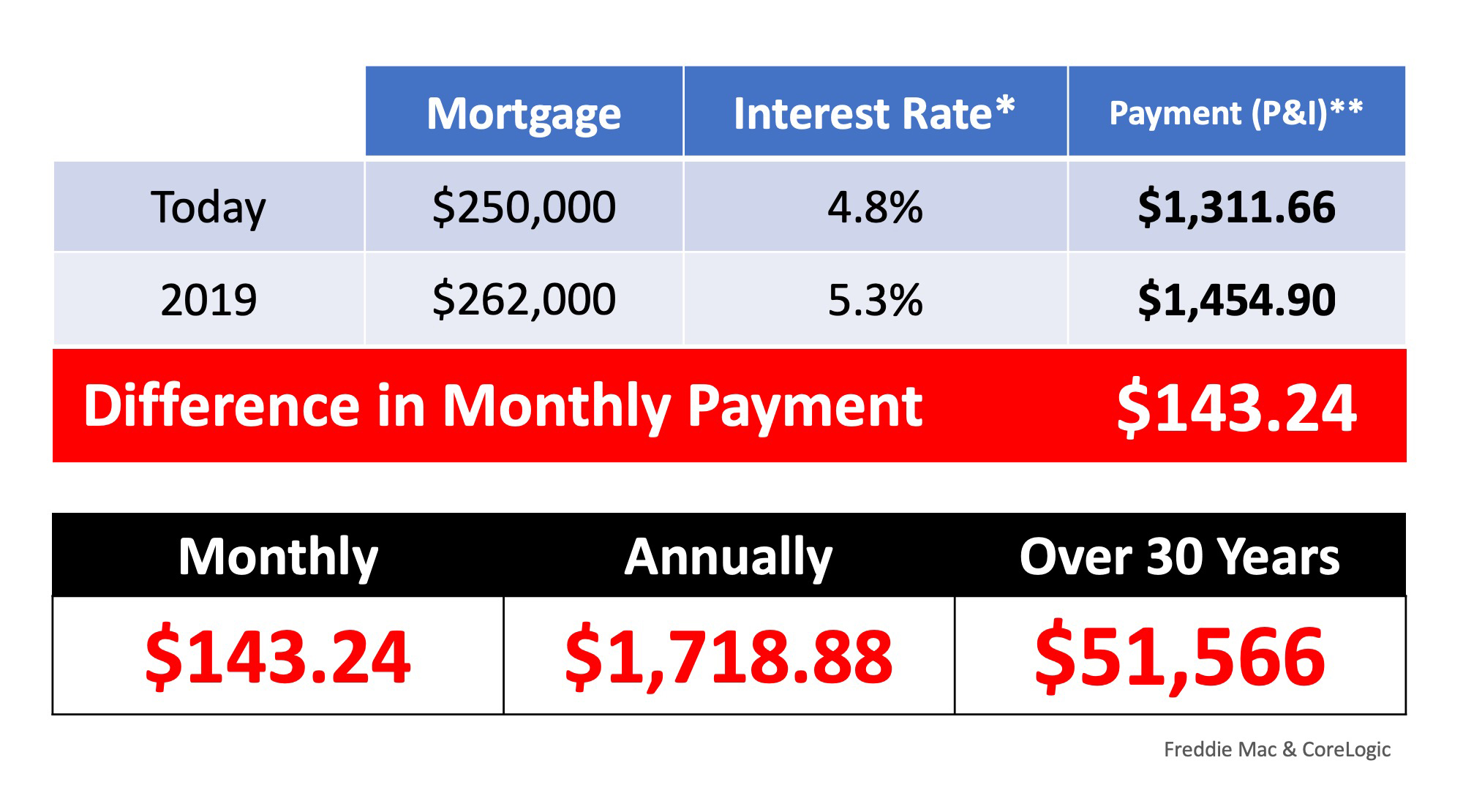

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Insights Report, home prices will appreciate by 4.8% over the next 12 months.

What Does This Mean as a Buyer?

If home prices appreciate by 4.8% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for this year, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

The Tale of Two Markets

![The Tale of Two Markets [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2018/12/04114908/20181207-STM-ENG-1046x1354.jpg)

Some Highlights:

- An emerging trend for some time now has been the difference between available inventory and demand in the premium and luxury markets and that in the starter and trade-up markets and what those differences are doing to prices!

- Inventory continues to rise in the luxury and premium home markets which is causing prices to cool.

- Demand continues to rise with lower-than-normal inventory levels in the starter and trade-up home markets, causing prices to rise on a year-over-year basis for 80 consecutive months.

51% of Homeowners Love Their Forever Homes …Do You?

Let’s get together so we can find you your dream home today!🏡😍

2008 vs. Now: Are Owners Using Their Homes as ATMs Again?

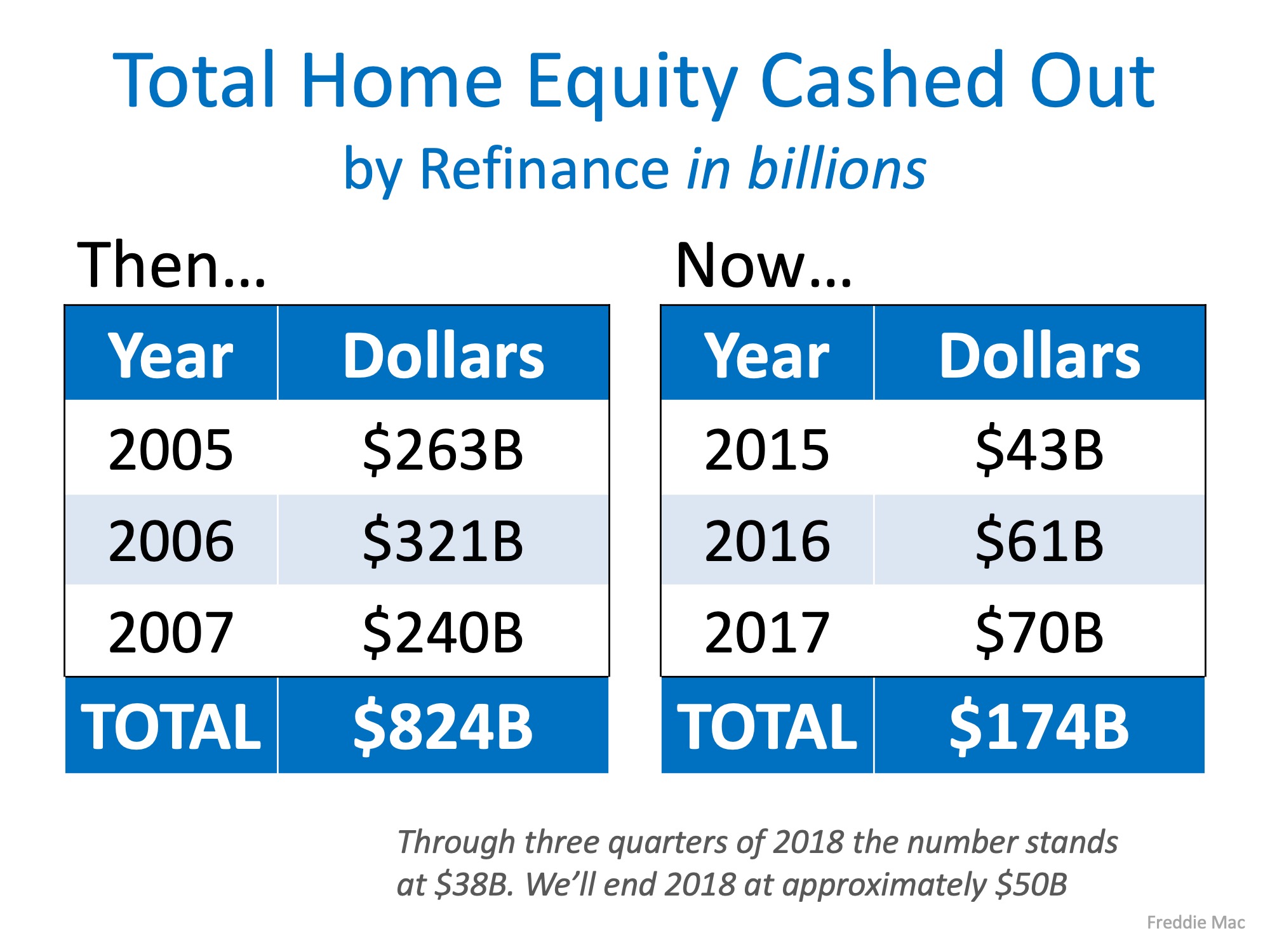

Over the last six years, we have experienced strong price appreciation which has increased home equity levels dramatically. As the number of “cash-out” refinances begins to approach numbers last seen during the crash, some are afraid that we may be repeating last decade’s mistake.

However, a closer look at the numbers shows that homeowners are being much more responsible with their home equity this time around.

What happened then…

When real estate values began to surge last decade, people started using their homes as personal ATMs. Homeowners would refinance their houses and convert their equity into instant cash (known as “cash-out” refinances). Because homes were appreciating so rapidly, many homeowners tapped into their equity multiple times.

This left homeowners with little-or-no equity left in their homes, so when prices started to fall many homeowners found their houses in a negative equity situation (where the mortgage amount was greater than the value of the home). When some of these homeowners saw that there was no value left in their houses, they just stopped paying their mortgages altogether.

Banks eventually foreclosed on those homes and the foreclosures drove prices down even further and put more homes in the negative equity category. This cycle continued, leading to the worst housing crash in almost one hundred years.

What’s happening now…

Again, Americans are seeing their home equity grow. Today, over 48% of all single-family homes in the country have over 50% equity, and yes, some families are tapping into that equity. However, this time around, homeowners are not making irresponsible decisions. According to the latest information from Freddie Mac, the total equity being “cashed out” is a fraction of what it was leading up to the crash. Here are the numbers:

Bottom Line

The recklessness that accompanied the build-up in equity prior to the last crash does not exist today. That makes this housing market much more secure than the one we had heading into 2008.

Where Are Interest Rates Headed in 2019?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate, the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily throughout 2019.

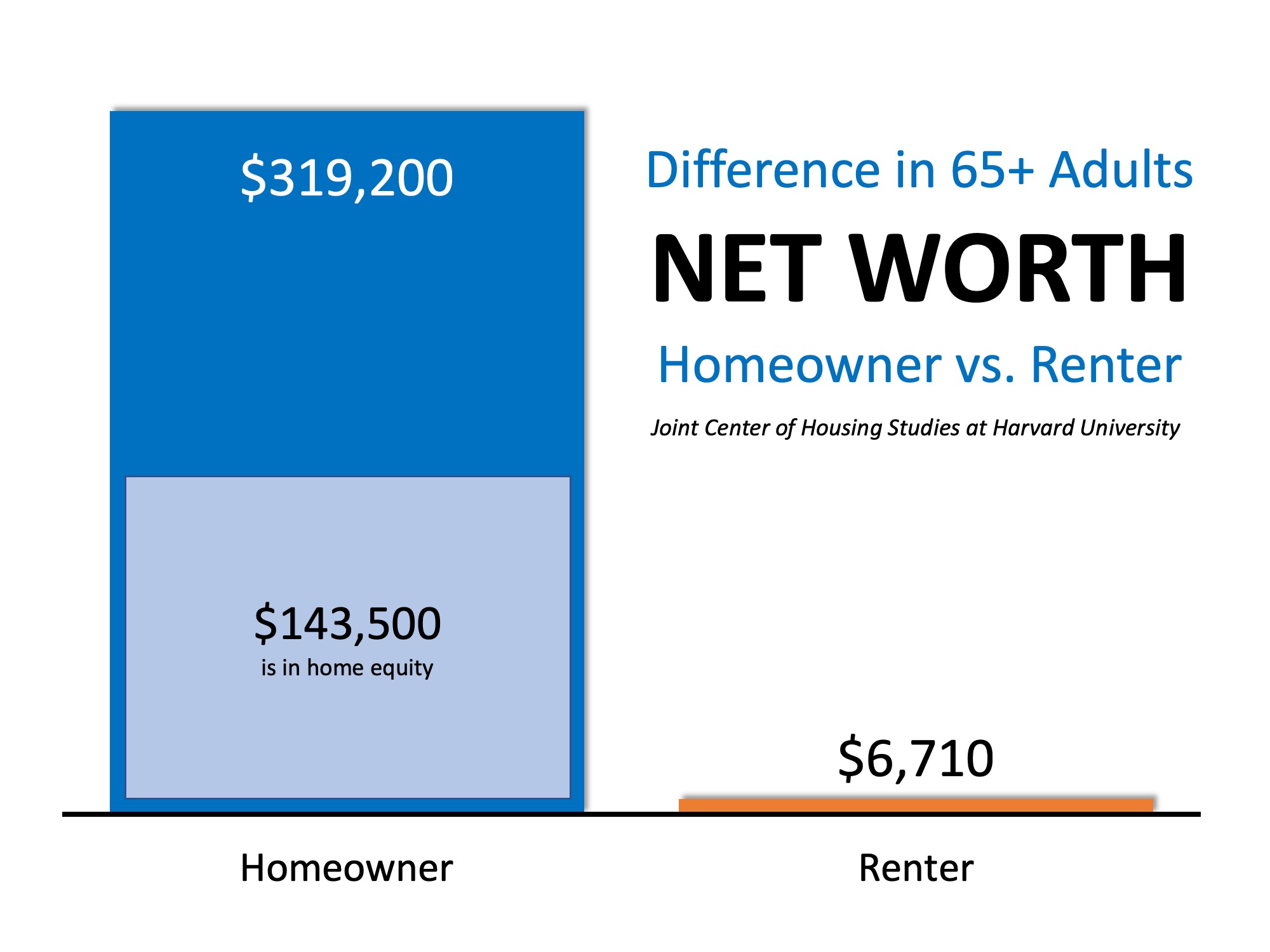

Homeowners Aged 65+ Have 48x More Net Worth Than Renters

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. Their latest survey data covers responses from 2013-2016.

The study revealed that the median net worth of a homeowner was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greaterthan that of a renter.

There are many who see that statistic and point toward how broad the range of respondents are for the Federal Reserve survey. Their study includes all economic and social groups and also includes all age groups. The argument is that older respondents have a higher likelihood of being homeowners, while the homeownership rate among younger survey takers is much lower.

Recently, the Joint Center for Housing Studies at Harvard University focused on homeowners and renters over the age of 65. Their study revealed that the difference in net worth between homeowners and renters at this age group was actually 47.5 times greater!

Homeowners over the age of 65 are much more financially prepared for retirement and often own their homes outright if they were fortunate enough to purchase their homes before the age of 36. Their 30 years of mortgage payments have paid off as they gained equity through their monthly payments and as home values appreciated.

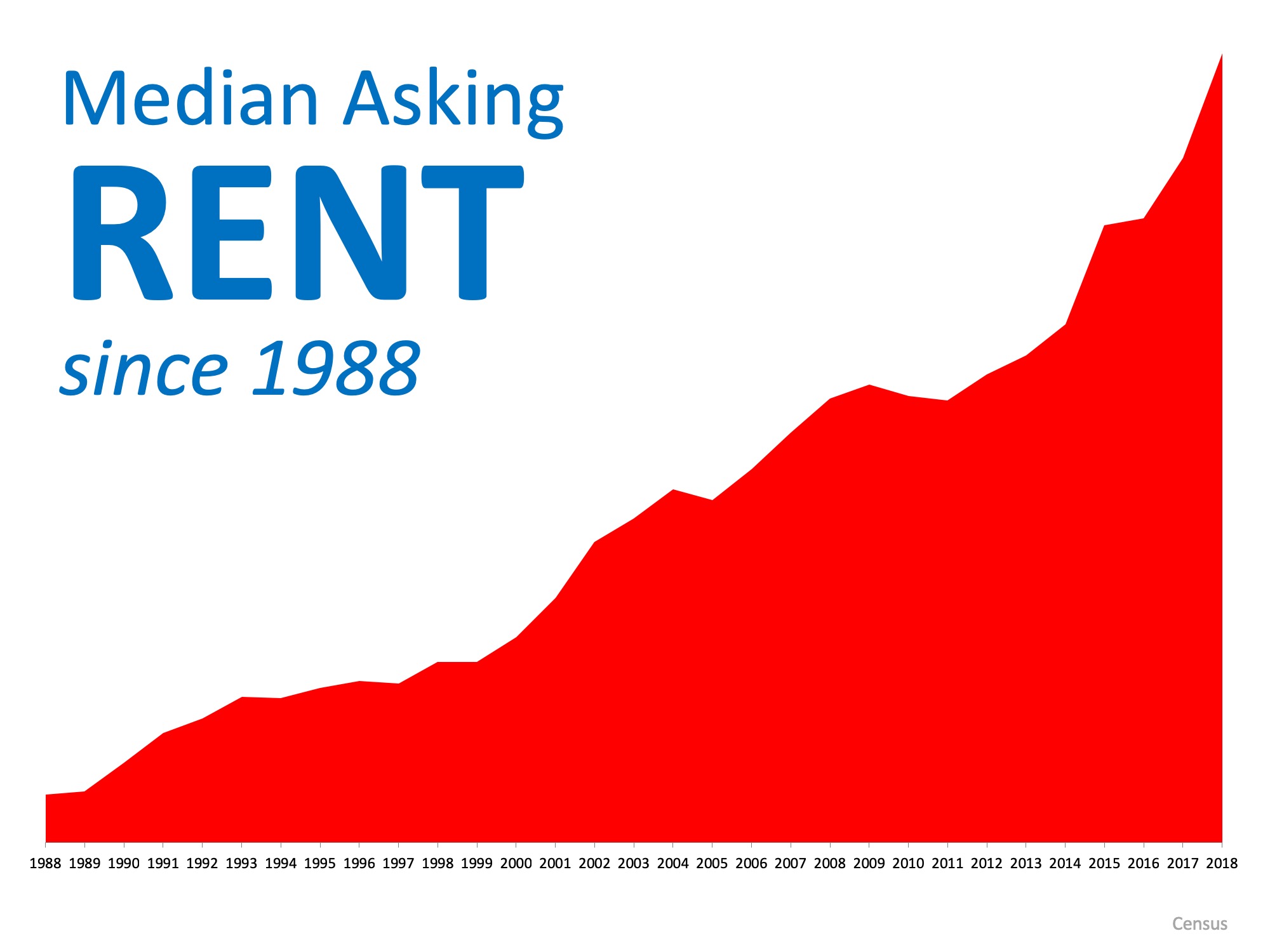

It is no surprise that lifelong-renters have had a hard time accruing net worth as the latest Census report shows that the Median Asking Rent has been climbing consistently over the last 30 years.

Bottom Line

As a homeowner you put your monthly mortgage payment to work for you, building your net worth with every payment.

4 Reasons to Buy A Home This Winter!

Who’s mortgage would you rather pay? Yours or your landlords?

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insight report revealed that home prices have appreciated by 5.6% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.7% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have hovered around 4.8%. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase in 2019.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person building that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on With Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.