Category Archives: Uncategorized

WHY ACCESS IS ONE OF THE MOST IMPORTANT FACTORS IN GETTING YOUR HOUSE SOLD!

Why Access Is One of the Most Important Factors in Getting Your House Sold!

So, when you decide to sell your home, you should hire a real estate professional, to help you through the entire process.

Listing with myself or another agent, you should be aware of the FOUR elements to a quality listing.

- ACCESS

- AVAILABILITY

- FINANCING

- PRICE

LOCK BOX/ACCESS – this allows buyers the ability to see the home as soon as they are aware of the listing, or at their convenience

AVAILABILITY – it’s in your best interest to have your home available to be previewed within a 30 minute window. You never know when an agent might be driving by your neighborhood and sees the for sale sign in your yard . By Appointment Only (example: 48-Hour Notice) – Many buyers who are relocating for a new career or promotion start working in that area prior to purchasing their home. They often like to take advantage of free time during business hours (such as their lunch break) to view potential homes. Because of this, they may not be able to plan their availability far in advance or may be unable to wait 48 hours to see the house FINANCING – ensure your agent has spoken with the selling agent about a potential buyers credit worthiness. Last thing you want to do, is show your home to someone, that has not taken the time to find out if they can even purchase a home

PRICE – If you are not following my Monday Pahrump Housing Market Trend Report emails, then you need to make sure you speak with your agent about your price. Ensure you are in the “appraised” value are of recent comparables. The last thing you want to happen, is to accept an offer, “contingent” upon appraised value, ONLY to find out your value was not there. Now you’ve lost critical days on the market as an ACTIVE listing.

Please CONNECTWITHTERESAPARKER, so you can find out the latest about our real estate market and upcoming events in the area.

Are You About To Be An Empty-Nester?

6460 North CARRIZO Lane, Pahrump, NV

6460 North CARRIZO Lane, Pahrump, NV

$ Click for current price

3 BEDROOMS | 2 Baths (2 full ) BATHROOMS | 1526 SqFt

***MOVE IN READY*** Beautifully upgraded home, recently RE-LEVELED, NEW ROOF, kitchen features new quartz counter-tops, island, reverse osmosis, new refrigerator, custom cabinets, vertical blinds, premium interior paint, upgraded vinyl floors, separate laundry room, master bedroom includes sitting room, master bath offers separate shower and tub, Features a fully enclosed sun room and shed for extra storage. THIS HOME IS A MUST SEE!

6460 North CARRIZO Lane, Pahrump, NV – Just Listed

6460 North CARRIZO Lane, Pahrump, NV

$ Click for current price

3 BEDROOMS | 2 Baths (2 full ) BATHROOMS | 1526 SqFt

***MOVE IN READY*** Beautifully upgraded home, recently RE-LEVELED, NEW ROOF, kitchen features new quartz counter-tops, island, reverse osmosis, new refrigerator, custom cabinets, vertical blinds, premium interior paint, upgraded vinyl floors, separate laundry room, master bedroom includes sitting room, master bath offers separate shower and tub, Features a fully enclosed sun room and shed for extra storage. THIS HOME IS A MUST SEE!

HOW QUICKLY CAN YOU SAVE YOUR DOWN PAYMENT?

How Quickly Can You Save Your Down Payment?

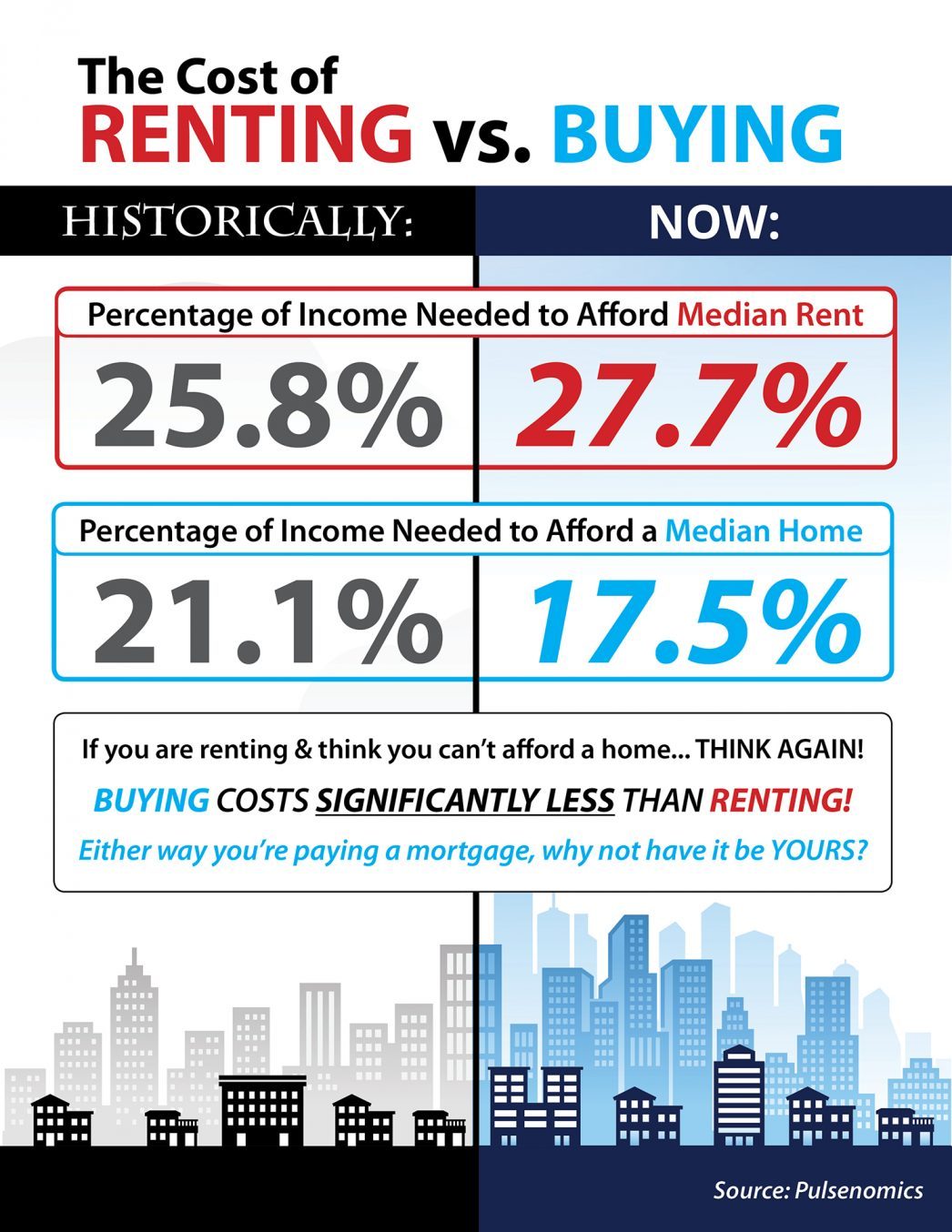

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, Continue reading

3 Questions You Need to Ask Before Buying a Home

3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

What Credit Score Do You Need To Buy A House?

What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Why an Economic Slowdown Will NOT Crush Real Estate this Time

Last week, the National Association for Business Economics released their February 2019 Economic Policy Survey. The survey revealed that a majority of the panel believe an economic slowdown is in the near future:

“While only 10% of panelists expect a recession in 2019, 42% say a recession will happen in 2020, and 25% expect one in 2021.”

Their findings coincide with three previous surveys calling for a slowdown sometime in the next two years:

- The Pulsenomics Survey of Market Analysts

- The Wall Street Journal Survey of Economists

- The Duke University Survey of American CFOs

That raises the question: Will the real estate market be impacted like it was during the last recession?

A recession does not equal a housing crisis. According to the dictionary definition, a recession is:

Continue reading

Tips For Making Your Dream of Buying a Home Come True

3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC]

![3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/02/20084419/3-Tips-ENG-MEM-1046x1354.jpg)

Some Highlights:

- Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking too much about it.

- Living within a budget right now will help you save money for down payments while also paying down other debts that might be holding you back.

- What are you willing to cut back on to make your dreams of homeownership a reality?